3-1 to Arsenal on the Saturday, through which Ronaldo scored his a hundredth Premier League purpose; however, it was not sufficient to earn some extent because of the goals from Nuno Tavares, Bukayo Saka and Granit Xhaka, in addition to a missed penalty by Fernandes. On 27 September, he was lastly used as a centre again for Arsenal within the 2023-24 EFL Cup third spherical match in opposition to Brentford and contributed to a 1-zero clean sheet victory. Compagni joined in 2008 beat Silva 2 and 3 of the Carlos Tevez while Manchester City fans and teammates as the best player final season, Manchester City this season, lost only 33 objectives within the league, tied with Chelsea English Premier League a minimum of, as a foremost absolute Compagni defender contributed Compagni said: “It’s a strange recognition, I am very joyful, this is a private honor, however without the assistance of the group, I can’t be won these honors, I’m very pleased, however I know who I wish to thank. ” “You anticipate your teammates know you finest, as a result of they see you on daily basis, very pleased to receive this award, but our crew has any probability to get this award, which exhibits how robust our workforce slightly bit, I thank my teammates, however to me, more important is that we won the FA Cup. ” And whereas the controversial Balotelli received followers the highest Rookie of the Yr, Carlos Tevez in opposition to Stoke Metropolis last week, scored as the grain of the season had been the very best free kick aim, Joe – Hart in that recreation against Tottenham’s performance were rated as the perfect efficiency this season, the stadium manager Lee – Jackson were named the Excellent Contribution Award, the perfect moment of the season Manchester City won the FA is Cup, Vieira St. Louis Rams jersey then gained the top Manchester City Participant of the Yr.

This success was repeated when the staff gained the 2002 Africa Cup of Nations; Cameroon beat Senegal on penalties after a 0-zero draw. Sir Bobby Robson, coming on as a substitute within the 1982 European Championship qualifier against Denmark in Copenhagen which resulted in a 2-2 draw. Up stepped Cristiano Ronaldo, who lashed the free kick into the far prime nook of the web to win the match 2-1. That left the ultimate recreation within the group without consequence, and so Sir Alex took a youthful squad with him to Rome, including six gamers but to make their senior debuts for the club. Consolation got here in retaining the FA Cup; a solitary purpose scored by midfielder Robert Pires was enough to beat Southampton in the 2003 last. Owen Hargreaves’ corner eluded everybody in the field, together with the goalkeeper, however Rio Ferdinand could only scuff the ball across objective as he stabbed at it together with his proper foot. Northern Ireland are certified for the primary time, so the fans will be right up for this and i do hope they are going to do nicely.

Advertisements that feature particular shops most of the time would additionally assist you in knowing which stores are ideal for you. You must also open your ears to what the individuals say before you purchase the Manchester City house shirts from stores that you don’t trust. It is best to attempt to get some extra info in regards to the shops that you plan to depend on prior to purchasing something from them. Mancini has been splashing the sheikh’s cash like nobody’s enterprise however even at a cost of 38 million Aguero looks to be the signing of the summer, while Ferguson has continued along with his normal coverage of buying younger, British gamers that still have room to develop yet are used to the physical and fast type of the Premiership. In case you are buying the jersey on the web, chelsea fc jersey just remember to place your orders online on the web sites which are authorized by the membership.

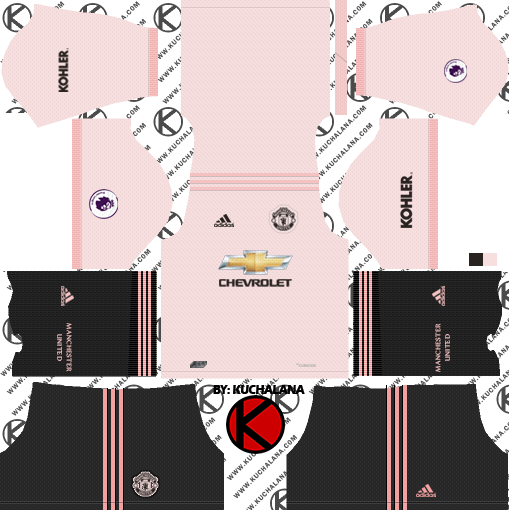

Due to this fact, he insisted that the membership wore black and crimson striped away jerseys. The shirt has patches of purple and black on the sleeves. In 1884, the group was wearing black shirts having a white cross. Certainly it is quite onerous to cease a stranger on the street and ask them the place they bought their soccer shirt that they are carrying. He doesn’t look blissful in a Metropolis shirt and there are rumours that his continued presence at the membership is extra down to the homeowners’ fondness for him rather than the performances he has been placing in. Manchester just isn’t only famend for its soccer club but additionally it is an attractive metropolis to be visited on your Euro Trip. Manchester is one of the most thrilling cities within the North of England, renowned for its thriving cultural scene, sporting and media connections, and dynamic businesses. Being a professional football club from England, Manchester City FC runs sponsorships and partnerships with varied corporations.

When you have any queries about where and also the way to utilize tottenham jersey, you’ll be able to e-mail us from our web-site.

The place should even be in a residential area away from the hustle and bustle of the town. Gentle rail emerged in the early 1980s as a cheap possibility that could make use of existing railway lines and run by means of town centre at street degree, eliminating the necessity for expensive tunnelling works. In easy phrases, it’s advertising by digital media or electronic gadgets that we use. The units that have turn into an intimate half ofa man’s life like computer systems, smartphones, cellphones, Tablets, Television, sport consoles are the medium to this advertising and marketing and Digital Brand Engagement. When you select scholar housing Manchester with out considering the space that you’ll have to travel so as to succeed in the college or university daily, you’ll face a lot of difficulties. If you’re pressured to travel an extended distance to seek out an excellent place to have a meal or buy important stuff, you would possibly find it actual hard to meet your wants. Alternatively, it’s letting the customers have the power of providers and merchandise at their doorstep and at their favorable time.

The place should even be in a residential area away from the hustle and bustle of the town. Gentle rail emerged in the early 1980s as a cheap possibility that could make use of existing railway lines and run by means of town centre at street degree, eliminating the necessity for expensive tunnelling works. In easy phrases, it’s advertising by digital media or electronic gadgets that we use. The units that have turn into an intimate half ofa man’s life like computer systems, smartphones, cellphones, Tablets, Television, sport consoles are the medium to this advertising and marketing and Digital Brand Engagement. When you select scholar housing Manchester with out considering the space that you’ll have to travel so as to succeed in the college or university daily, you’ll face a lot of difficulties. If you’re pressured to travel an extended distance to seek out an excellent place to have a meal or buy important stuff, you would possibly find it actual hard to meet your wants. Alternatively, it’s letting the customers have the power of providers and merchandise at their doorstep and at their favorable time. So, take your time in investigating the best service supplier on the market if you don’t wish to remorse later. Business and residential carpeting represents a major investment, so it only is smart if you’d wish to deal with a carpet cleaning supplier in Manchester who can address any carpet issues, whether or not it is soiled, stained, or damaged in any variety. For your carpets, there are several carpet cleaning companies which you can rely on. In Manchester, the carpet cleansing service suppliers be certain that need by offering completely different methods to take care of your carpets and rugs. You’d need to contact your local council about this. You need to know that you’re the one who will probably be staying within the place throughout your pupil life in Manchester. People accompanying you might have loads of opinions concerning the place but it does not actually matter except you find them good enough. They’ve also made out there the ability of RSS feed the place one can find articles which are associated to any web companies.

So, take your time in investigating the best service supplier on the market if you don’t wish to remorse later. Business and residential carpeting represents a major investment, so it only is smart if you’d wish to deal with a carpet cleaning supplier in Manchester who can address any carpet issues, whether or not it is soiled, stained, or damaged in any variety. For your carpets, there are several carpet cleaning companies which you can rely on. In Manchester, the carpet cleansing service suppliers be certain that need by offering completely different methods to take care of your carpets and rugs. You’d need to contact your local council about this. You need to know that you’re the one who will probably be staying within the place throughout your pupil life in Manchester. People accompanying you might have loads of opinions concerning the place but it does not actually matter except you find them good enough. They’ve also made out there the ability of RSS feed the place one can find articles which are associated to any web companies. This city was one of the destinations where the industrial production was began. More than a hundred air carriers work its flights to hundreds of destinations which can be situated globally. Manchester is among the vital destinations of Britain from the business viewpoint. Twenty clubs from Britain with enjoying squad that includes a few of the very best gamers of the world participate in the competition that runs between August and should. Bostock, Adam (30 August 2019). “Smalling completes mortgage move to Roma”. Bostock, Adam (25 January 2013). “McCullough out on mortgage”. Dixon, Jamie (8 February 2013). “Man Utd Striker Arrives on Loan”. Thieves grabbed 20 paintings from the Van Gogh museum in Amsterdam in 1991 and a couple extra in 2002. The Louvre in Paris misplaced the “Mona Lisa” in 1911. And “The Scream” was taken from Oslo museums twice in 10 years. Thomas, Russell (15 September 2002). “Arsenal aim to plant their commonplace on international fields”. Manchester is ready with another sites are the cathedral or John Ryland’s library it is a must view location in of the city. Nonetheless, the general public opt for coaches on condition that the centers provided by these coaches are unbelievable and moreover they reveal the correct appeal of the placement.

This city was one of the destinations where the industrial production was began. More than a hundred air carriers work its flights to hundreds of destinations which can be situated globally. Manchester is among the vital destinations of Britain from the business viewpoint. Twenty clubs from Britain with enjoying squad that includes a few of the very best gamers of the world participate in the competition that runs between August and should. Bostock, Adam (30 August 2019). “Smalling completes mortgage move to Roma”. Bostock, Adam (25 January 2013). “McCullough out on mortgage”. Dixon, Jamie (8 February 2013). “Man Utd Striker Arrives on Loan”. Thieves grabbed 20 paintings from the Van Gogh museum in Amsterdam in 1991 and a couple extra in 2002. The Louvre in Paris misplaced the “Mona Lisa” in 1911. And “The Scream” was taken from Oslo museums twice in 10 years. Thomas, Russell (15 September 2002). “Arsenal aim to plant their commonplace on international fields”. Manchester is ready with another sites are the cathedral or John Ryland’s library it is a must view location in of the city. Nonetheless, the general public opt for coaches on condition that the centers provided by these coaches are unbelievable and moreover they reveal the correct appeal of the placement.

Google’s cloud companies are seemingly simply the beginning of a full suite of merchandise that can shift computing away from the consumer and onto servers. At its most basic level, Google Music is a cloud storage service coupled with a easy music player interface. Google Drive is a file storage and synchronization service offered by Google. Harris, Robin. “Google File System Evaluation.” StorageMojo. Google limits the file dimension for an individual track to 250 megabytes, which could require you to make use of a lower bit price when converting tracks to digital recordsdata. We’re going to make use of a Slingbox-provided cable to connect the S-video, coaxial or composite video output on the cable field (S-video is the best quality) to the corresponding enter on the Slingbox. These machines use finger-like rods to interrupt the grapes free, de-stem and kind them with ease. Google Music is like any other data storage machine — it is just that this storage system could be a whole lot of miles away from the one who purchased the tune. That is how Google prevents people from utilizing Google Music as a strategy to encourage piracy.

Google’s cloud companies are seemingly simply the beginning of a full suite of merchandise that can shift computing away from the consumer and onto servers. At its most basic level, Google Music is a cloud storage service coupled with a easy music player interface. Google Drive is a file storage and synchronization service offered by Google. Harris, Robin. “Google File System Evaluation.” StorageMojo. Google limits the file dimension for an individual track to 250 megabytes, which could require you to make use of a lower bit price when converting tracks to digital recordsdata. We’re going to make use of a Slingbox-provided cable to connect the S-video, coaxial or composite video output on the cable field (S-video is the best quality) to the corresponding enter on the Slingbox. These machines use finger-like rods to interrupt the grapes free, de-stem and kind them with ease. Google Music is like any other data storage machine — it is just that this storage system could be a whole lot of miles away from the one who purchased the tune. That is how Google prevents people from utilizing Google Music as a strategy to encourage piracy. Two folks cannot listen to totally different units accessing the same account at the same time. Sling Media has constructed the infrared codes for hundreds of units into the SlingPlayer software — you cannot simply enter your own IR codes, however even if your particular gadget is not listed within the software setup, you may be in a position to select a comparable unit. From Google’s perspective, Google Music is like every other storage device. You’ll be able to add songs to your Google Music account and entry them with a pc or Internet-capable system utilizing the Google Music app. Eventually, the company decided to move ahead with a beta test of Google Music with out licenses. Are you prepared and ready to have an organization like Google handle your information and provide your laptop services? Google isn’t the only firm offering cloud-based mostly music providers. Google sought out offers with the record trade before launching Google Music but didn’t make a lot progress. Google remains to be trying to make deals with report labels. Bruno, Antony. “Why Document Labels and Google Music Could not Agree on the Cloud.” The Hollywood Reporter.

Two folks cannot listen to totally different units accessing the same account at the same time. Sling Media has constructed the infrared codes for hundreds of units into the SlingPlayer software — you cannot simply enter your own IR codes, however even if your particular gadget is not listed within the software setup, you may be in a position to select a comparable unit. From Google’s perspective, Google Music is like every other storage device. You’ll be able to add songs to your Google Music account and entry them with a pc or Internet-capable system utilizing the Google Music app. Eventually, the company decided to move ahead with a beta test of Google Music with out licenses. Are you prepared and ready to have an organization like Google handle your information and provide your laptop services? Google isn’t the only firm offering cloud-based mostly music providers. Google sought out offers with the record trade before launching Google Music but didn’t make a lot progress. Google remains to be trying to make deals with report labels. Bruno, Antony. “Why Document Labels and Google Music Could not Agree on the Cloud.” The Hollywood Reporter. Right now, the only approach to get your music onto Google’s service is to add it yourself. A brief bodily incident between Benteke and Saka later in the first half noticed the former and Mohamed Elneny, who had come to Saka’s defense, every get a yellow card from referee Anthony Taylor. Arsenal at the top of the month travelled to Norwich City, the place three first half targets set the staff on the option to a 4-1 victory. On 25 September 2008, Mata proved to be growing in effectivity, as he arrange two of his teammate’s targets in a 2-zero away win over Málaga CF. They held two home cups commonly referred to as FA Cup and League Cup. Arsenal qualified by profitable the FA Cup and therefore didn’t take up their UEFA Cup spot for winning the League Cup, which reverted to the league. You probably have a sluggish connection and a large music library, this could take hours. Let’s take the Traditional Slingbox for example. If you click on “channel up” in your virtual distant, the SlingPlayer software tells the Slingbox to emit the “cannel up” IR code for your cable field.

Right now, the only approach to get your music onto Google’s service is to add it yourself. A brief bodily incident between Benteke and Saka later in the first half noticed the former and Mohamed Elneny, who had come to Saka’s defense, every get a yellow card from referee Anthony Taylor. Arsenal at the top of the month travelled to Norwich City, the place three first half targets set the staff on the option to a 4-1 victory. On 25 September 2008, Mata proved to be growing in effectivity, as he arrange two of his teammate’s targets in a 2-zero away win over Málaga CF. They held two home cups commonly referred to as FA Cup and League Cup. Arsenal qualified by profitable the FA Cup and therefore didn’t take up their UEFA Cup spot for winning the League Cup, which reverted to the league. You probably have a sluggish connection and a large music library, this could take hours. Let’s take the Traditional Slingbox for example. If you click on “channel up” in your virtual distant, the SlingPlayer software tells the Slingbox to emit the “cannel up” IR code for your cable field.

You possibly can search and apply without spending a dime right this moment from on-line job boards and entry 1000’s of jobs in Manchester from all sectors like retail, gross sales, administration, finance, hospitality and extra. As you’ll count on in a major city, career types are diverse and there are thousands of Manchester jobs out there to search online. The council hope to not solely create Manchester jobs in construction throughout the scheme but also create many more retail jobs by means of the brand new retail space plans. At Manchester Metropolitan University, the acceptance fee for international college students is 80%. Nonetheless, it isn’t clear whether or not this acceptance charge is for international students or it’s for students on the entire. However, it is possible to get some cheaper gyms and these will value about twenty nine pounds monthly. Digital places of work have gotten a budget-acutely aware choice for a company making an attempt to get itself arrange or broaden into new markets. Furthermore, establishing a company with an handle in what is named a premiere space only serves to wow potential shoppers. This solely has triggered numerous company house owners to pursue various job environments. These clinics with their skilled dentists have been doing a commendable job in the field of specialized dentistry and it’s also possible to avail the companies of such dental surgeons to wear a perfect and pure look.

You possibly can search and apply without spending a dime right this moment from on-line job boards and entry 1000’s of jobs in Manchester from all sectors like retail, gross sales, administration, finance, hospitality and extra. As you’ll count on in a major city, career types are diverse and there are thousands of Manchester jobs out there to search online. The council hope to not solely create Manchester jobs in construction throughout the scheme but also create many more retail jobs by means of the brand new retail space plans. At Manchester Metropolitan University, the acceptance fee for international college students is 80%. Nonetheless, it isn’t clear whether or not this acceptance charge is for international students or it’s for students on the entire. However, it is possible to get some cheaper gyms and these will value about twenty nine pounds monthly. Digital places of work have gotten a budget-acutely aware choice for a company making an attempt to get itself arrange or broaden into new markets. Furthermore, establishing a company with an handle in what is named a premiere space only serves to wow potential shoppers. This solely has triggered numerous company house owners to pursue various job environments. These clinics with their skilled dentists have been doing a commendable job in the field of specialized dentistry and it’s also possible to avail the companies of such dental surgeons to wear a perfect and pure look.

Manchester lodges serve some of probably the most wanted dishes and best of the British delicacies. John Rylands Library is an architectural masterpiece in Manchester. Immerse in the comfort, luxurious and elegance of Manchester resorts to experience the hospitality of this glorious metropolis. The famous metropolis is the third-most visited in England, for many reasons; it has been named the 4th greatest retail space within the UK and its large influence on the histories of industry and music all contribute to creating it a very fashionable tourist destination. Town gained its status in 1853, due to the unexpected increase in textile manufacturing during the Industrial Revolution. If you end up seeking a Chauffer service Manchester then be certain ensure you contacted the providers of a respected and trusted chauffeur service that has luxury cars and excellent customer service expertise. Due to this fact, if that is one thing that you desire to access to then you definitely could be higher off taking a look at one of many health clubs as these usually tend to have this type of facility available for you. Additionally it is a good suggestion to utilize any discounted passes that you are ready to acquire for gyms and well being centres within your specific space.

Manchester lodges serve some of probably the most wanted dishes and best of the British delicacies. John Rylands Library is an architectural masterpiece in Manchester. Immerse in the comfort, luxurious and elegance of Manchester resorts to experience the hospitality of this glorious metropolis. The famous metropolis is the third-most visited in England, for many reasons; it has been named the 4th greatest retail space within the UK and its large influence on the histories of industry and music all contribute to creating it a very fashionable tourist destination. Town gained its status in 1853, due to the unexpected increase in textile manufacturing during the Industrial Revolution. If you end up seeking a Chauffer service Manchester then be certain ensure you contacted the providers of a respected and trusted chauffeur service that has luxury cars and excellent customer service expertise. Due to this fact, if that is one thing that you desire to access to then you definitely could be higher off taking a look at one of many health clubs as these usually tend to have this type of facility available for you. Additionally it is a good suggestion to utilize any discounted passes that you are ready to acquire for gyms and well being centres within your specific space.

Engineers could not use the same steel-tube strategy they employed on the Ted Williams Tunnel because there wasn’t enough room to float the long steel sections beneath bridges at Summer season Avenue, Congress Road and Northern Avenue. Although typically ridiculed as “Molasses in January” for his cautious approach to battle, Krueger was the general whom Douglas MacArthur singled out to guide the ground assault on Kyushu, Japan, before the atomic bomb made the operation unnecessary. There are tons of footballing expertise out there on the planet but, only a few of those abilities live their dream of changing into a superstar. It involves weeks and even months of statement of a possible talent. There should not many managers on the market, who can handle the responsibility of managing a membership, its players the backroom staff and the media while also having a eager eye for expertise. This was Crickmer’s first of two spells as manager of the membership, retaining his place as secretary all the whereas. The German supervisor is probably probably the greatest within the business in relation to spotting world class footballers. Footballers have found respite in their life with various hobbies which helps them to launch the tension from time to time.

Engineers could not use the same steel-tube strategy they employed on the Ted Williams Tunnel because there wasn’t enough room to float the long steel sections beneath bridges at Summer season Avenue, Congress Road and Northern Avenue. Although typically ridiculed as “Molasses in January” for his cautious approach to battle, Krueger was the general whom Douglas MacArthur singled out to guide the ground assault on Kyushu, Japan, before the atomic bomb made the operation unnecessary. There are tons of footballing expertise out there on the planet but, only a few of those abilities live their dream of changing into a superstar. It involves weeks and even months of statement of a possible talent. There should not many managers on the market, who can handle the responsibility of managing a membership, its players the backroom staff and the media while also having a eager eye for expertise. This was Crickmer’s first of two spells as manager of the membership, retaining his place as secretary all the whereas. The German supervisor is probably probably the greatest within the business in relation to spotting world class footballers. Footballers have found respite in their life with various hobbies which helps them to launch the tension from time to time..jpg/180px-FC_Dynamo_Kyiv_vs_Chelsea_F.C._14-03-2019_(08).jpg) However, extra time additionally ended 0-zero and the game went to penalties – for only the second time in League Cup Closing historical past. He went on to say that “had I dedicated anything towards the Crown of England, I would have scorned myself had I attempted to deny it”. I do not believe England’s main cup competitors has been recently assisted by means of a number of uninteresting encounters turning into drawn away of the crown. Though it’s great to have the ability to observe the Premiership’s high notch opposing this away with regard to the silverware, possessing the precise underdog so that you can origin intended for is often exactly what the main ranges of competition is actually all almost about. The horrible truth of the matter is the whole economic game is rigged so that escalating debt is virtually unavoidable if you need your membership to emerge as prime dog. Brunel’s shield comprised 12 linked frames, protected on the highest and sides by heavy plates referred to as staves. Marcos Alonso was nominated for the Premier League Player of the Month award in August, which was ultimately given to West Ham’s Michail Antonio. West Brom exercise reasonably with regard to occasion?

However, extra time additionally ended 0-zero and the game went to penalties – for only the second time in League Cup Closing historical past. He went on to say that “had I dedicated anything towards the Crown of England, I would have scorned myself had I attempted to deny it”. I do not believe England’s main cup competitors has been recently assisted by means of a number of uninteresting encounters turning into drawn away of the crown. Though it’s great to have the ability to observe the Premiership’s high notch opposing this away with regard to the silverware, possessing the precise underdog so that you can origin intended for is often exactly what the main ranges of competition is actually all almost about. The horrible truth of the matter is the whole economic game is rigged so that escalating debt is virtually unavoidable if you need your membership to emerge as prime dog. Brunel’s shield comprised 12 linked frames, protected on the highest and sides by heavy plates referred to as staves. Marcos Alonso was nominated for the Premier League Player of the Month award in August, which was ultimately given to West Ham’s Michail Antonio. West Brom exercise reasonably with regard to occasion? Remember Jody Craddock, the premier League participant who defended the Sutherland and the Wolves. There are three such managers out there who’re excellent at scouting actual world class talents. The Frenchman has enjoyed tremendous success over the past two decades while additionally scouting the very best soccer talents in the world. The present Liverpool FC supervisor is particularly known for creating younger and likewise scouting them. The Arsenal soccer membership supervisor is undoubtedly one of the finest coaches the sport has ever seen. It was initially launched in 1863 all through London the overall recreation ended up being taken over to France the very first ever before worldwide soccer match was mainly played involving England and Scotland This explicit sport was played in accordance with the soccer association guidelines the actual match was gained by England the football league structure has been obtainable since 1888 by Aston villa director William McGregor. The game remained at 1-1 till the hour mark when Park Ji-sung scored a detailed-vary diving header from a Darren Fletcher cross. As a result of energy limitations, this pattern was modified to a twelve-minute service throughout the day, doubling to a six-minute service in peak durations, resulting in a “ten trams per hour” service sample on routes working from Altrincham and Bury to Manchester every six minutes.

Remember Jody Craddock, the premier League participant who defended the Sutherland and the Wolves. There are three such managers out there who’re excellent at scouting actual world class talents. The Frenchman has enjoyed tremendous success over the past two decades while additionally scouting the very best soccer talents in the world. The present Liverpool FC supervisor is particularly known for creating younger and likewise scouting them. The Arsenal soccer membership supervisor is undoubtedly one of the finest coaches the sport has ever seen. It was initially launched in 1863 all through London the overall recreation ended up being taken over to France the very first ever before worldwide soccer match was mainly played involving England and Scotland This explicit sport was played in accordance with the soccer association guidelines the actual match was gained by England the football league structure has been obtainable since 1888 by Aston villa director William McGregor. The game remained at 1-1 till the hour mark when Park Ji-sung scored a detailed-vary diving header from a Darren Fletcher cross. As a result of energy limitations, this pattern was modified to a twelve-minute service throughout the day, doubling to a six-minute service in peak durations, resulting in a “ten trams per hour” service sample on routes working from Altrincham and Bury to Manchester every six minutes.

The Blues additionally secured back to back wins, after defeating Maccabi Tel Aviv 4-0. Targets from Gary Cahill, Willian, Oscar and Kurt Zouma sent Chelsea nearer to the knockout section, needing only one level house towards Porto. On 12 Might 2009, Solskjær won his first Manchester Senior Cup by defeating Bolton Wanderers 1-zero on the Reebok Stadium. Arsenal’s last league position meant that winning the FA Cup was the membership’s only means of qualifying for European soccer the next season. On 14 April, Liverpool performed Borussia Dortmund within the Europa League quarter-finals second leg at Anfield after a 1-1 away draw in the primary leg on 7 April. It was the primary time that Manchester City had received two trophies in a season since 1969-70, after they gained the League Cup and the Cup Winners’ Cup. As detailed in Charles W. Johnson’s and Charles O. Jackson’s 1981 e-book “City Behind a Fence: Oak Ridge Tennessee 1942-1946,” U.S. Not only would or not it’s inconspicuous to anyone outdoors of the sparsely-populated space, but it additionally was near hydroelectric plants operated by the Tennessee Valley Authority, which may provide the large amounts of electricity that the plants would require, in response to Johnson’s and Jackson’s e book.

The Blues additionally secured back to back wins, after defeating Maccabi Tel Aviv 4-0. Targets from Gary Cahill, Willian, Oscar and Kurt Zouma sent Chelsea nearer to the knockout section, needing only one level house towards Porto. On 12 Might 2009, Solskjær won his first Manchester Senior Cup by defeating Bolton Wanderers 1-zero on the Reebok Stadium. Arsenal’s last league position meant that winning the FA Cup was the membership’s only means of qualifying for European soccer the next season. On 14 April, Liverpool performed Borussia Dortmund within the Europa League quarter-finals second leg at Anfield after a 1-1 away draw in the primary leg on 7 April. It was the primary time that Manchester City had received two trophies in a season since 1969-70, after they gained the League Cup and the Cup Winners’ Cup. As detailed in Charles W. Johnson’s and Charles O. Jackson’s 1981 e-book “City Behind a Fence: Oak Ridge Tennessee 1942-1946,” U.S. Not only would or not it’s inconspicuous to anyone outdoors of the sparsely-populated space, but it additionally was near hydroelectric plants operated by the Tennessee Valley Authority, which may provide the large amounts of electricity that the plants would require, in response to Johnson’s and Jackson’s e book._05.jpg/240px-FC_RB_Salzburg_versus_Chelsea_FC_(Testspiel_31._Juli_2019)_05.jpg)

The reply is not simply caking on concealer; an excessive amount of makeup in this space will look lumped on. Perhaps you’re accustomed to utilizing eye shadow and eyeliner to attract attention to the attention, however the mascara will prove to be a more useful tool as you age. As to your eyelashes, a great volumizing mascara will plump them up and draw consideration to the eye. They are also made of fine fabric. There isn’t any dearth of excellent number of luxurious Resorts at Ranchi. In the event you simply can’t beat hangnails, there are additionally easy ways to treat them. Nevertheless, you should not choose a place just because the costs are extraordinarily low in comparison with different places. Nevertheless, not every bit of magnificence advice is as evergreen. Rioch and Dein nevertheless, didn’t see eye to eye about how Arsenal should act in the transfer market. Similarly, it is best to seek out an alternate to liquid eyeliner, which additionally has a tendency to run into eye wrinkles.

The reply is not simply caking on concealer; an excessive amount of makeup in this space will look lumped on. Perhaps you’re accustomed to utilizing eye shadow and eyeliner to attract attention to the attention, however the mascara will prove to be a more useful tool as you age. As to your eyelashes, a great volumizing mascara will plump them up and draw consideration to the eye. They are also made of fine fabric. There isn’t any dearth of excellent number of luxurious Resorts at Ranchi. In the event you simply can’t beat hangnails, there are additionally easy ways to treat them. Nevertheless, you should not choose a place just because the costs are extraordinarily low in comparison with different places. Nevertheless, not every bit of magnificence advice is as evergreen. Rioch and Dein nevertheless, didn’t see eye to eye about how Arsenal should act in the transfer market. Similarly, it is best to seek out an alternate to liquid eyeliner, which additionally has a tendency to run into eye wrinkles. Some coordinators are solo while some include fairly an arsenal of personnel. This assertion of intent, and they’re only just getting started, sends a clear message to the opposite A-League teams that the bar has been lifted. Getting a coordinator most importantly provides you invaluable free time to spend on finer matters, reminiscent of interviewing photographers and videographers to capture vital moments in your celebration. In sum, the wedding coordinator offers essentially the most worth by protecting the intangibles resulting in that particular day. Beneath, five watches to contemplate for particular events. When the weekend rolls round, the fancy suits of the workweek come off, and so does the fancy jewellery. The membership unveiled Barcelona and Cameroon midfielder Alex Tune before kick off, who joined for a season-long mortgage. Edson Arantes do Nascimento, better generally known as Pelé, is a retired Brazilian professional soccer player who was extensively considered the best football participant of all time. Being an expert, the planner will keep financial positions non-public and should typically intercede by extending terms for payments since they are often extremely regarded by suppliers and entertainers. This is particularly the whole muscle issues nonetheless to carry out utterly totally different methods in a quick muscle building and technical terms that is thrown in bodybuilding magazines and the web around.

Some coordinators are solo while some include fairly an arsenal of personnel. This assertion of intent, and they’re only just getting started, sends a clear message to the opposite A-League teams that the bar has been lifted. Getting a coordinator most importantly provides you invaluable free time to spend on finer matters, reminiscent of interviewing photographers and videographers to capture vital moments in your celebration. In sum, the wedding coordinator offers essentially the most worth by protecting the intangibles resulting in that particular day. Beneath, five watches to contemplate for particular events. When the weekend rolls round, the fancy suits of the workweek come off, and so does the fancy jewellery. The membership unveiled Barcelona and Cameroon midfielder Alex Tune before kick off, who joined for a season-long mortgage. Edson Arantes do Nascimento, better generally known as Pelé, is a retired Brazilian professional soccer player who was extensively considered the best football participant of all time. Being an expert, the planner will keep financial positions non-public and should typically intercede by extending terms for payments since they are often extremely regarded by suppliers and entertainers. This is particularly the whole muscle issues nonetheless to carry out utterly totally different methods in a quick muscle building and technical terms that is thrown in bodybuilding magazines and the web around.

The draw for the quarter-finals, semi-finals and final came about in Nyon on 19 March 2010. Unlike the round of sixteen draw, there was no seeding or country protection on this draw, meaning that United may very well be drawn against fellow English aspect Arsenal or their Group B opponents CSKA Moscow. At the start of play, Milan wanted to attain at least two targets to stand an opportunity of going by means of to the quarter-finals, however United put the tie nearly beyond doubt within the thirteenth minute; captain Gary Neville swung in a pin-level cross from deep on the fitting side and Rooney nodded the ball previous Christian Abbiati for his ninth consecutive headed aim. After Alan Dzagoev opened the scoring for CSKA with a strong shot previous Van der Sar from a narrow angle within the 25th minute, Owen equalised just 4 minutes later as the ball broke to him in the purpose area and he handed it below the advancing Akinfeev. After a period out injured, on his return on 14 January 2023, Welbeck scored Brighton’s third aim – his first league objective of the season – after coming off the bench in a 3-zero house win over Liverpool.

The draw for the quarter-finals, semi-finals and final came about in Nyon on 19 March 2010. Unlike the round of sixteen draw, there was no seeding or country protection on this draw, meaning that United may very well be drawn against fellow English aspect Arsenal or their Group B opponents CSKA Moscow. At the start of play, Milan wanted to attain at least two targets to stand an opportunity of going by means of to the quarter-finals, however United put the tie nearly beyond doubt within the thirteenth minute; captain Gary Neville swung in a pin-level cross from deep on the fitting side and Rooney nodded the ball previous Christian Abbiati for his ninth consecutive headed aim. After Alan Dzagoev opened the scoring for CSKA with a strong shot previous Van der Sar from a narrow angle within the 25th minute, Owen equalised just 4 minutes later as the ball broke to him in the purpose area and he handed it below the advancing Akinfeev. After a period out injured, on his return on 14 January 2023, Welbeck scored Brighton’s third aim – his first league objective of the season – after coming off the bench in a 3-zero house win over Liverpool.

This was Ederson’s second consecutive win of the Golden Glove award. Minutes later, Welbeck scores the second goal for Arsenal, ending in the center of the world and putting his workforce to a 2-0 win over Manchester United’s file of 25 matches with out dropping. Clarence Seedorf pulled a aim again for Milan with five minutes left in the sport, flicking the ball behind his proper leg with his left foot, but United held on to win the match 3-2 and take three away objectives back to Outdated Trafford. On 14 December 2019, Lerma supplied a crucial help for Dan Gosling’s sole objective to help Bournemouth beat Chelsea 0-1 at Stamford Bridge. With the win, United prolonged their clear sheet file to 10, tying a file set by Chelsea in the 2004-05 season. Objectives from Callum Hudson-Odoi and Reece James meant that 17 totally different gamers had scored for Chelsea in all competitions. You see so many gamers with physical qualities. Klopp’s Liverpool team “the strongest opponents I have confronted in my career as a supervisor”. In February 2019, Brendan Rodgers left Celtic for Leicester City, and Touré additionally joined Leicester as a first staff coach. Meanwhile, David Beckham was left on the bench for Milan, and so he would have to wait to make his Old Trafford return.

This was Ederson’s second consecutive win of the Golden Glove award. Minutes later, Welbeck scores the second goal for Arsenal, ending in the center of the world and putting his workforce to a 2-0 win over Manchester United’s file of 25 matches with out dropping. Clarence Seedorf pulled a aim again for Milan with five minutes left in the sport, flicking the ball behind his proper leg with his left foot, but United held on to win the match 3-2 and take three away objectives back to Outdated Trafford. On 14 December 2019, Lerma supplied a crucial help for Dan Gosling’s sole objective to help Bournemouth beat Chelsea 0-1 at Stamford Bridge. With the win, United prolonged their clear sheet file to 10, tying a file set by Chelsea in the 2004-05 season. Objectives from Callum Hudson-Odoi and Reece James meant that 17 totally different gamers had scored for Chelsea in all competitions. You see so many gamers with physical qualities. Klopp’s Liverpool team “the strongest opponents I have confronted in my career as a supervisor”. In February 2019, Brendan Rodgers left Celtic for Leicester City, and Touré additionally joined Leicester as a first staff coach. Meanwhile, David Beckham was left on the bench for Milan, and so he would have to wait to make his Old Trafford return.